Virtual Event Hosted by Sydney and Five Others

TAMPA, Fla., June 23, 2020 — Sydney Consulting Group, a fast-growing actuarial, compliance, and general services consulting firm, is grateful to have hosted and participated in the Supplemental Product Summit. The virtual, two day event was one of the largest, if not the largest, supplemental product event(s) of the year. Topics addressed during the event included mental health, voluntary (i.e. employee paid) product trends, cyber security, product filing and compliance trends, risk management in the current COVID-19 environment, and the opportunity cost of legacy underwriting systems.

The first session, Mental Health Gaps & Solutions, was presented by Christin Kuretich of Trustmark Voluntary Solutions, Owen Muir, MD of Brooklyn Minds, and Bill Bade, FSA, MAAA of Sydney Consulting Group. The panelists noted the current absence of mental health coverage in the supplemental product market, discussed the clinical approach to treating mental health, and merged the clinical / product nuances to suggest real-world product changes. The session was widely praised as increasing the awareness of mental health treatment options and encouraging innovation in product design.

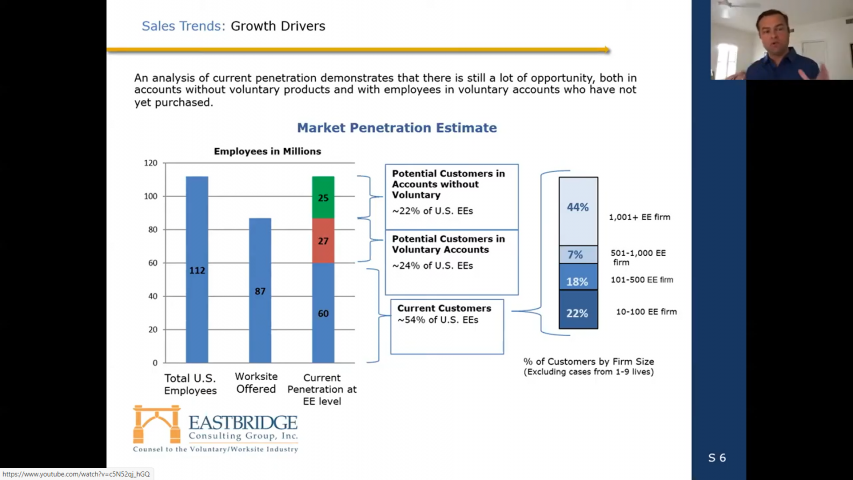

The second session, Voluntary Product Trends for 2020 & Beyond, featured Nick Rockwell of Eastbridge Consulting Group, Sanja Zehnder, FSA, MAAA of CNO Financial Group, and Mike Prendes, FSA, MAAA of Sydney Consulting Group. The session featured specific metrics from Eastbridge Consulting Group, including market segmentation of the $8.8b in new business premium in 2019, the estimated takeover percentage of 56%, and the estimated market penetration of 54%. The group also introduced areas for innovation in both individual and group market segments.

The third session, Cyber Security Threats to Voluntary Benefits, was moderated by Heather Garbers of Hub International and presented by Arturo Perez-Reyes of Hub International as well as Bill Bade, FSA, MAAA of Sydney Consulting Group. Attendees were introduced to the significant cyber security risks inherent with third party vendors, and even internal networks, with Mr. Perez-Reyes noting that COVID-19 could be the largest cyber security event in human history. The group also presented specific, actionable items insurance carriers can use to mitigate cyber security risk.

The fourth session, Compliance Trends in Supplemental Products, received extraordinary audience support and interaction. The session was led by Ginny McHugh of McHugh Consulting Resources, and highlighted state perspectives on Accident, Cancer, Critical Illness, and Hospital Indemnity products. Attendees were treated to state filing details including specific issues in outlier jurisdictions such as California, New Hampshire, and others.

Jim Filmore, FSA, MAAA and Dawn McMaster from Munich Re presented the fifth session, Managing Risk & Reward During Uncertain Times. The interactive session discussed the most current information related to the COVID-19 pandemic, including fatality, infection, and hospitalization rates as well as specific considerations for life, disability, cancer, critical illness, and hospital indemnity products. The well-prepared and highly educational penultimate session combined several areas of research to engage a broad spectrum of issues.

The final session, The Opportunity Cost of Legacy Underwriting & Pricing, was masterfully delivered by Garrett Viggers and Alex Terry, FSA, MAAA of Limelight Health. Garrett and Alex quantified the impact of legacy underwriting and pricing systems using a hypothetical case study of both active and passive approaches to modernization. In particular, Garrett and Alex described how systems can both streamline and eliminate certain business functions.

All technology support for the event was provided by Limelight Health. In addition, Jason Andrew, CEO of Limelight Health, graciously shared his Company’s approach to diversity, inclusion, mental health, and racism during a Q&A on Tuesday, June 23rd. The event also included the keynote speaker Denis Phillips of ABC Action News in Tampa, FL.

The PDFs of each presentation may be found at the following links:

- Session #1 – Mental Health Gaps & Solutions

- Session #2 – Voluntary Product Trends

- Session #3 – Cyber Security Threats

- Session #4 – Compliance Trends

- Session #5 – Managing Risk Reward During Uncertain Times

- Session #6 – Opportunity Cost of Legacy Underwriting

- Full Agenda

The videos of each presentation may be found on YouTube via Limelight Health’s channel at the following links:

- Session #1 – Mental Health Gaps & Solutions

- Session #2 – Voluntary Product Trends

- Session #3 – Cyber Security Threats

- Session #4 – Compliance Trends

- Session #5 – Managing Risk Reward During Uncertain Times

- Session #6 – Opportunity Cost of Legacy Underwriting

About Sydney Consulting Group

Sydney Consulting Group provides actuarial, compliance, FP&A, and strategic consulting to carriers, employers, and producers. Product experience includes, but is not limited to, Accident Indemnity, Accident Medical Expense, Cancer, Critical Illness, Short Term Disability, Hospital Indemnity, Long Term Care, Medical Gap, Medicare Supplement, Short Term Care, Term Life, Universal Life, and Whole Life. Sydney Consulting Group is a client-focused organization built on the carrier and consultant leadership experience of its staff.